Table of Contents

ToggleMY MRA Portal: Revolutionizing Tax Administration in Mauritius

- In an era where digital transformation is paramount, the Mauritius Revenue Authority (MRA) has taken significant strides to modernize and streamline tax administration by launching the MY MRA Portal. This innovative platform is designed to enhance the efficiency, transparency, and user experience for taxpayers in Mauritius, providing a seamless interface for various tax-related activities. Let’s delve into the MY MRA Portal’s features, benefits, and impact on individual taxpayers and businesses.

Features of the MY MRA Portal

The MY MRA Portal is a comprehensive online platform offering many features to simplify tax processes. Some of the key features include:

- User-Friendly Interface: The portal’s interface is intuitive and user-friendly, making it easy for users of all tech-savvy levels to navigate and utilize its functionalities.

- E-Filing of Returns: One of the standout features is the ability to electronically file tax returns. This includes income tax, VAT returns, and other tax-related documents, reducing the need for physical submissions and minimizing errors.

- Payment Gateway Integration: The portal integrates with various payment gateways, allowing taxpayers to pay their taxes online securely and conveniently. This feature supports multiple payment methods, including credit/debit cards and bank transfers.

- Real-Time Notifications: Taxpayers receive real-time updates and notifications regarding their tax filings, payments, and any other relevant activities, ensuring they are always informed about their tax status.

- Document Management: Users can upload, store, and manage their tax-related documents within the portal, providing a centralized repository for all their tax information.

- Tax Calculators and Tools: The portal offers a range of calculators and tools to help taxpayers estimate their tax liabilities and plan their finances accordingly.

- 24/7 Access: Being an online platform, the MY MRA Portal is accessible 24/7, allowing taxpayers to manage their tax affairs at their convenience without being constrained by office hours.

How To log in to MY MRA Portal

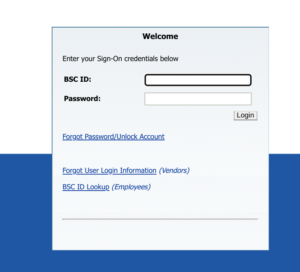

The MY MRA Portal login process offers taxpayers in Mauritius a seamless and secure gateway to manage their tax affairs online. Upon accessing the portal’s login page, users are prompted to enter their unique credentials, typically a username and password. Once authenticated, users can access a personalized dashboard to perform myriad tax-related activities, including electronic filing of tax returns, making payments, accessing historical tax data, and receiving real-time notifications.

The login process prioritizes security, employing robust encryption protocols to safeguard sensitive taxpayer information and ensure data privacy. With its intuitive interface and stringent security measures, the MY MRA Portal login empowers taxpayers with convenient, 24/7 access to their tax accounts, fostering greater efficiency and transparency in tax administration across Mauritius.

Log in to the MY MRA Portal and follow these simple steps:

- Access the Portal: Open your preferred web browser and navigate to the official MY MRA Portal website.

- Locate the Login Section: Once on the portal’s homepage, locate the login section. This is prominently displayed on the homepage or accessible through a “Login” or “Sign In” button.

- Enter Your Credentials: In the login section, enter your username and password in the designated fields. When you register for access to the portal, these credentials are usually provided to you.

- Click Login: After entering your credentials, click the “Login” button to proceed.

- Access Your Dashboard: Upon successful authentication, you will be redirected to your personalized dashboard within the MY MRA Portal. Here, you can view your tax information, file returns, make payments, and perform other tax-related activities.

- Logout: Once you have completed your tasks, it’s important to log out of your account to ensure the security of your information. Look for the “Logout” option, which is typically located in the top right corner of the portal’s interface.

By following these steps, you can quickly and securely log in to the MY MRA Portal and access the various features and functionalities it offers

Benefits of the MY MRA Portal

The introduction of the MY MRA Portal brings numerous benefits to both the MRA and taxpayers:

- Increased Efficiency: Automating tax processes through the portal significantly reduces processing times and administrative burdens, leading to faster turnaround times for tax-related activities.

- Enhanced Accuracy: The digital nature of the portal minimizes human errors in tax filings and calculations, ensuring more accurate and reliable data.

- Cost Savings: The portal reduces the need for paper-based processes, cutting down on printing and mailing costs for the government and taxpayers.

- Greater Transparency: The portal gives taxpayers greater visibility into their tax status, history, and transactions, promoting transparency and trust in the tax system.

- Improved Compliance: With easy access to tax information and tools, taxpayers are better equipped to comply with tax laws and regulations, potentially reducing instances of non-compliance.

- Convenience and Accessibility: Taxpayers can access the portal from anywhere, making it easier to fulfill their tax obligations without needing physical visits to tax offices.

Impact on Tax Administration

The MY MRA Portal represents a significant leap forward in Mauritius’s digital transformation of tax administration. By leThecan provide a more efficient, transparent, and taxpayer-friendly service. The impact of leveraging technology portals can be seen in several areas:

- Modernized Tax System: Adopting the MY MRA Portal is a step towards a more modern and sophisticated tax system that aligns with international best practices.

- Improved Taxpayer Engagement: The portal fosters better communication and engagement between the MRA and taxpayers, enhancing the overall taxpayer experience.

- Economic Growth: By simplifying tax processes and improving compliance, the portal can contribute to a more stable and predictable revenue stream for the government, supporting economic growth and development initiatives.

- Capacity Building: The portal’s implementation and ongoing use help build the capacity of both MRA staff and taxpayers to use digital tools and platforms, fostering a culture of digital literacy.

Conclusion

The MY MRA Portal is a testament to the Mauritius Revenue Authority’s commitment to leveraging technology to improve tax administration. The portal benefits taxpayers and enhances the tax system’s overall effectiveness by offering a comprehensive, user-friendly, and efficient platform. Formation continues to reshape public services, and the MY MRA Portal stands as a model of innovation and progress in tax administration, paving the way for a more efficient, transparent, and taxpayer-centric future.

OntPressCom Fresh Updates: A Comprehensive Guide

Exploring the McMinn Portal: A Guide to Its Features and Benefits

Discover the Boom Bah Sports Complex: A Haven for Athletes and Sports Enthusiasts